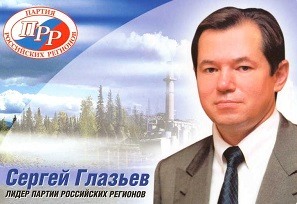

Sergei Glaziev: Stupidity Is Worse Than Theft

Sergei Glaziev: Stupidity Is Worse Than Theft

(Translation: Alice, S, Gideon, Marina. Editing: D.M. Pennington, Michael, Peter, Heather, Bernie, Patricia, Tom, Kristin.) Why did the Central Bank raise the interest rate and let the ruble flow? ● Another increase in key interest rates on loans issued by the Bank of Russia, for the purpose of refinancing commercial banks, made loans completely inaccessible for the majority of enterprises of the real sector of the economy. When the average profitability of the manufacturing industry is 7.5-8%, credit issued at rates of 10% or higher cannot be used by most businesses, either for investment or for replenishing working capital. Such decisions cut off the real economy, with the exception of some sectors of the oil, gas, and chemical-metallurgical sector, from credit issued by the State. ● Prior to that, the consumer lending boom drove millions of citizens into a 10-trillion ruble debt and the real economy lost the savings of the population, becoming a net debtor. Also, the Government withdrew pension savings from the economy. Sanctions imposed by NATO countries deprive the economy of the bulk of external credit. Most businesses have only their own funds to finance working capital and investments, which is clearly not enough to provide even simple reproduction, never mind an expanded one. The amount of profit of enterprises this year (taking into account the fall in the prices of export goods) will be no more than 10% of the required rate of investment of 25-30% of GDP. It’s no surprise that as a result of such decisions amidst the economic recovery in almost all countries of the world this year, Russia is experiencing an unexpected decline in investment and production. ● According to the Central Bank’s report, On the key rate of the Bank of Russia, October 31, 2014, its decision to raise interest rates was made because of external circumstances: “In September-October the external environment has changed significantly: oil prices dropped significantly while there has been a tightening of sanctions imposed by individual countries to a number of large Russian companies. The ruble has been weakening in this environment, which, against the backdrop of August’s restrictions on import of certain food products, led to a further acceleration of growth of consumer prices”. To support its previous decision to raise interest rates, the Central Bank argued that “inflationary risks had increased, including rising geopolitical tensions and their possible impact on the dynamics of the course of the national currency, as well as changes in the tax and tariff policy.” In the same policy statement, the Central Bank explained its decision to raise interest rates by “a stronger than expected effect of exchange rate dynamics on consumer prices, rising inflation expectations, as well as the unfavorable trends in the market for certain goods.” ● This reasoning does not stand up to criticism.