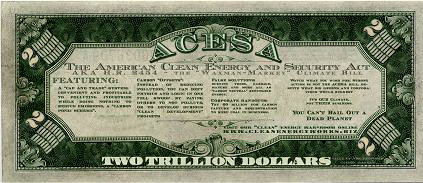

Congressional Climate Bills - Stealth Schemes to Raise Energy Prices and Enrich Wall Street

On June 26, 2009, HR 2454: American Clean Energy and Security Act of 2009 (ACESA) passed, purportedly "To create clean energy jobs, achieve energy independence, reduce global warming pollution and transition to a clean energy economy."

In fact, it lets energy polluters raise prices for huge windfall profits and gives Wall Street a bonanza through carbon trading derivatives speculation. Catherine Austin Fitts' Solari.com blog explained it last July in her article titled, "The Next Really Scary Bubble" is coming, saying:

"If you think the housing and credit bubble diminished your financial security and your community, or the bailouts, or the rising gas prices did as well, hold on to your hat" for what's ahead. "Carbon trading is gearing up to make the housing and derivative bubbles look like target practice," or in other words, be the mother of all scams, courtesy of administration, House and Senate collaboration with Wall Street and the energy giants.

Now the Senate version - a clean energy bill? Not according to the Center for Biological Diversity (biologicaldiversity.org) calling it:

"a disaster for our climate and planet. (The Kerry-Lieberman) proposal moves us one baby step forward and at least three giant steps back in any rational effort to address the climate crisis. (Their bill) would entrench our addiction to fossil fuels by offering incentives for increased oil and gas drilling just days after what appears to be the worst offshore oil disaster in American history."

Their proposal includes "no safeguards....to make offshore oil safe. (It) echoes greenhouse pollution reduction targets that scientists recently called 'paltry' and inadequate to prevent the worst impacts of climate change....The Kerry-Lieberman (bill) is not the answer because it asks the wrong questions."

New climate legislation must:

● reduce "atmospheric carbon dioxide to 350 parts per million....;"

="#3D2B1F">● supplement "existing environmental laws - especially the Clean Air Act - instead of gutting these successful and proven environmental protections;"

● be "free of loopholes allowing polluters to delay or avoid reducing their greenhouse gas emissions;" and

● avoid "habitat destruction and increased greenhouse gas emissions through perverse subsidies."

House of Senate bills fail "these tests." They're "a disaster for our climate and planet." The House bill lets polluters "escape real emissions reductions." The Senate bill:

● bans Clean Air Act provisions and "existing state and local efforts to tackle climate change;"

="#3D2B1F">● facilitates, subsidizes, and accelerates oil and gas drilling, including offshore;

● "subsidize(s) dangerous and costly nuclear energy; and

● incentivize(s) the destruction of forests for biomass energy production;" this provision, however, appears stalled.

Last June, Public Citizen called the House bill:

"a new legal right to pollute (that) gives away 85 percent of (its) credits to polluters. (It) will not solve our climate crisis but will enrich already powerful oil, coal and nuclear power companies" at the expense of consumers stuck with higher than ever bills to enrich them.

This writer's July 8 article titled, Obama's Cap and Trade Carbon Emissions Bill: A Stealth Scheme to License Pollution and Fraud explained it.

Hyperbolic Democrats praised it, Speaker Pelosi calling it "transformational legislation which takes us into the future" after taking congratulatory calls from Obama, Senate Majority Leader Harry Reid and Al Gore.

The former vice president has long-standing ties to Goldman Sachs (GS), and in 2004, he and David Blood, GS's former asset management division CEO, co-founded Generation Investment Management LLC, a firm likely to profit hugely from cap and trade schemes if enacted.

So will energy giants like Royal Dutch Shell (top-ranked in 2009 on Fortune's Global 500) and Duke Energy that helped write the bill, that according to Friends of the Earth President Brent Blackwelder "fails to come anywhere close to solving the climate crisis. Worse, (it) eliminates preexisting EPA authority to address global warming - that means it's actually a step backward."

Greepeace agreed saying it "sets emission reduction targets far lower than science demands, then undermines even those targets with massive offsets. The giveaways and preferences in the bill will actually spur a new generation of nuclear and coal-fired power plants to the detriment of real energy solutions."

Energy companies praised it, and why not. Big Coal got a waiver until 2025. Agribusiness was exempted altogether even though it contributes up to one-fourth of greenhouse gas emissions. The free allowances provision benefits the nuclear industry hugely. The nation's largest nuclear power company, Exelon, said it would reap a $1 - 1.5 billion annual windfall from subsidies and higher prices.

ACESA is a scam. It's about profits, not environmental remediation. Its emissions reduction targets are so weak, they effectively license polluters by giving them a new profit center to exploit. As for Wall Street, it offers greater than ever derivatives trading profits - a new multi-trillion dollar market to be "securitized, derivatized, and speculated," according to Clinton's former Commerce undersecretary, Robert Shapiro. If cap and trade becomes law, the market will explode in his judgment.

Others agree, seeing a speculative bonanza, why FIRE sector (finance, insurance and real estate) lobbyists spent a record $465 million in 2009 according to the Center for Responsive Politics. Energy and natural resources companies also, spending $409 million to assure a plum this sweet becomes law.

The American Power Act (APC) - Unveiled on May 16 and now available in Pdf form at: http://kerry.senate.gov/americanpoweract/intro.cfm.

It's as hyperbolic as the House version saying it

"will transform our economy, set us on the path toward energy independence and improve the quality of the air we breathe. It will create millions of good jobs that cannot be shipped abroad and it will launch America into a position of leadership in the global clean energy economy."

It claims not to be about enriching Wall Street, but to reduce carbon pollution by "17 percent in 2020 and by over 80 percent in 2050," so far ahead that who'll remember unmet targets.

It says:

● "Consumers will come out on top.

="#3D2B1F">● We need energy made in America.

● America needs to regain its competitive edge....

● We need a new approach to reducing emissions (and)

● The system must be simple, stable and secure."

Friends of the Earth President Erich Pica debunked it, saying:

"Without dramatic improvements, this bill should not be passed, and senators should consider alternatives. In the meantime, existing tools like the Clean Air Act must be put to work. More broadly, we must end a system in which polluter lobbyists exercise effective veto power in Congress. Our economy, global security and the health of the public are all at stake."

According to Public Citizen's Tyson Slocum in his May 13 analysis, APC fails across the board saying the "Climate Bill Is a Misnomer: It's a Nuclear Energy-Promoting, Oil-Drilling-Championing, Coal Mining-Boosting Gift to Polluters....with a weak carbon-pricing mechanism thrown in."

Worse still, it guts the EPA's authority to regulate greenhouse gases as pollutants under the Clean Air Act. It provides nuclear power incentives at taxpayers expense. Under sections 1101 and 1105, citizens won't have public hearings on nuclear power risks, especially ones in their communities. Section 1102 "increases loan guarantees primarily for nuclear power to a jaw-dropping $54 billion." Considering the industry's high default risk, consumers will be stuck with the bill the way they've paid trillions for Wall Street bailouts.

In section 1103, 12 proposed nuclear plants will get $6 billion in taxpayer-subsidized risk insurance. Section 1121 lets nuclear power operators accelerate depreciation. Section 1121 "provides a 10 percent investment tax credit for new reactors." Under section 1123, the industry gets Advanced Energy Project credits, and it "derives certain tax, bond and grant benefits from investing in nuclear power" from sections 1124, 5 and 6.

More than ever, Big Oil gets to "Drill Baby, Drill" (that assures "Spill Baby, Spill"), including more of it offshore, despite the spreading Gulf disaster, and there's more. Under section 1202, states may keep 37.5 of oil and gas royalties. "That's like saying because more rich people live in California and New York compared to Mississippi and New Mexico, (they) should be able to keep more federal dollars raised from income taxes. Royalty revenue sharing is patently unfair," especially since offshore spills respect no state shorelines or inland areas if they spread.

Big coal will get generous loan guarantees and more. "Section 1412 establishes a (utility-collected) carbon tax paid by ratepayers....to fund carbon capture and storage (CCS) - with no money allocated to rooftop solar or energy efficiency investments." Under section 1431, coal companies are given (taxpayer subsidized) emissions allowances - "an untested, risky strategy that benefits (them) and is gobbling up a lion's share of subsidies" that should go for renewable energy development.

Merchant coal power plants (whose rates aren't regulated) will get about 5% of the handouts, "which will provide opportunities for them to gouge consumers."

Section 1604 says because "voluntary" renewable energy markets are efficient and effective programs, "the policy of the United States is to continue to support" them without the guarantees given fossil fuel and nuclear industry giants.

The bill also promotes carbon offsets trading - a scam to let polluters buy credits from countries or companies whose greenhouse gas emissions fall below their allowed quotas. However, shifting isn't reduction. It simply transfers pollution from one place to another, has no verification mechanism, creates a system wide open to fraud and mismanagement, and allows the same market manipulation shenanigans that created the housing and toxic derivatives bubbles - precisely why energy giants and Wall Street want it.

Utilities, not consumers, will benefit from free 2013 - 2029 allowances, "exclusively" for ratepayers purportedly. But instead of remitting directly to them, the Senate bill lets state utility commissions decide. They, in turn, can be more or less consumer friendly, but as their past history shows, ratepayers will end up losers.

As for Wall Street, the Senate bill is marginally less accommodative than the House version, but not enough to matter. For example, a new Commodities Futures Trading Commission (CFTC) Office of Carbon Market Oversight is created, letting the corporate-run agency regulate spot and futures emission markets.

It would require emissions traders to register, be approved, and have their transactions cleared through a CFTC-run Carbon Clearing Organization. It'll work the same way the Federal Reserve regulates banks - by letting the giants that own it make the rules.

Further, carbon trading lets Wall Street "control our climate future" by "mak(ing) the housing and derivatives bubbles look like target practice," as Catherine Austin Fitts explained.

If cap and trade is enacted, polluters will win. Consumers will lose, and Wall Street will get the mother of all speculative bonanzas. No wonder, they and the energy giants are lobbying ferociously for passage.

Connection to the Gulf Disaster

On May 9, Attorney General Eric Holder told ABC's This Week that he sent Justice Department officials to the Gulf to determine if any "misfeasance (or) malfeasance" occurred.

Is the Senate climate bill perhaps connected to the Gulf spill? - being used as a pretext to propose "protections," including a provision saying:

"Mindful of the accident in the Gulf, we institute important new protections for coastal states by allowing them to opt out of drilling up to 75 miles from their shores. In addition, directly impacted states can veto drilling plans if they stand to suffer significant adverse impacts in the event of an accident."

Don't bet on it, as House and Senate bills, in fact, assure more, not less, offshore drilling, thus far prohibited in oil rich waters Big Oil companies covet. But what they want, they generally get, free from regulatory oversight or not enough to matter. That won't change nor the chance for more spills, on or offshore. As one expert explained: "As long as we keep using this stuff, we're going to be spilling it. It goes with the territory."

Yet if the Gulf incident was deliberate, why so? On September 30, S. 1733: Clean Energy Jobs and American Power Act was introduced, purportedly to "create clean energy jobs, promote energy independence, reduce global warming pollution, and transition to a clean energy economy."

On November 5, it was reported to the Senate Environment and Public Works Committee, remained stalled, and the December Copenhagen climate summit (COP 15) failed. Then after the April 20 Gulf incident, it was reactivated to take advantage of a good crisis - what White House Chief of Staff Rahm Emmanuel once told the Wall Street Journal saying:

"You never want to let a serious crisis go to waste. What I mean by that is that it's an opportunity to do things you thought you couldn't do before."

And a joint Kerry-Lieberman statement said ahead of the bill's rollout:

"We are more encouraged today that we can secure the necessary votes to pass this legislation this year in part because the last weeks have given everyone with a stake in this issue a heightened understanding that as a nation, we can no longer wait to solve this problem which threatens our economy, our security and our environment."

White House climate advisor, Carol Browner, told Bloomberg TV that:

"This accident, this tragedy, is actually heightening people's interest in energy in this country and in wanting a different energy plan."

Perhaps they, BP, Transocean and Halliburton know something we don't. In this case a possible false flag "accident" to jump-start passage of the Senate bill to enrich polluters and Wall Street, the only way they may have thought possible after Senate debate stalled.

Of course, to enlist enough public and congressional support, a headline-making incident was needed, though doubtful one this grave was intended - according to some experts spewing from 40,000 - 100,000 gallons daily to continue for months, even years given the enormous underwater pressure at a one-mile depth - 40,000 pounds per square inch, the reason fixes so far tried have failed, and no one's sure what'll work. The latest BP tube insertion may be more a PR stunt than a solution, but don't look for its officials or Washington to explain it.

Extremely worrisome are the enormous deep water oil plumes, one, for example, 16 km long, five km wide, and 91 meters thick, suggesting permanent ecological damage with untold consequences. Already, oxygen in the Gulf is depleting, threatening sea life over a vast area and the livelihoods of area fishermen.

As for the industry's likely cost, it's pocket change, especially as others (including Washington and perhaps the states), not the offenders, will pay the most. Consider the Exxon Valdez disaster.

It occurred in March 1989. After years of litigation, plaintiffs got $385 million in compensatory damages and $5 billion in punitive ones. However, after numerous appeals, the Supreme Court (in June 2008) reduced the latter ones to $500 million - ten cents on the dollar or the equivalent of about 1.5 days profit from Exxon's Q 1 2008 operations, or hardly enough to matter.

As for Prince William sound and its residents, its beaches are still contaminated. The high-pressure hoses did more harm than good. They destroyed interlocking layers of gravel and flushed away fine sediments that protect beach areas, clams and mussels during storms. As many as 300,000 seabirds were killed plus other wildlife.

A Trustee Council study found 17 of 27 monitored species haven't recovered. Bio-accumulation of toxins affected the killer whale population. Clams are inedible from hydrocarbon poisoning. Shellfish damage slowed the recovery of otters that feed on them. The herring never returned. Salmon caught have abscesses and tumors, and the lives of about 32,000 plaintiffs were permanently disrupted economically, emotionally and culturally by bankruptcies, alcoholism, suicides, family violence, and divorces. And today the area still smells like a gas station and perhaps will for decades.

As for enacting Senate energy legislation, falsely called a climate bill, the battle lines are now drawn, including for offshore drilling, but given its importance to Big Oil, expect heavy-lifting lobbying for passage, whether or not this year. Whatever happens, expect the public to lose out to powerful corporate interests, especially energy and Wall Street ones spending millions to assure it.

___________________________________________________________________________________

Stephen Lendman: I was born in 1934 in Boston, MA. Raised in a modest middle class family, attended public schools, received a BA from Harvard University in 1956 and an MBA from the Wharton School at the University of PA in 1960 following 2 years of obligatory military service in the US Army. Spent the next 6 years as a marketing research analyst for several large US corporations before becoming part of a new small family business in 1967, remaining there until retiring at the end of 1999. Have since devoted my time and efforts to the progressive causes and organizations I support, all involved in working for a more humane and just world for all people everywhere, but especially for the most needy, disadvantaged and oppressed. My efforts since summer 2005 have included writing on a broad range of vital topics ranging from war and peace; social, economic and political equity for all; and justice for all the oppressed peoples of the world like the long-suffering people of Haiti and the Palestinians. Also co-hosting The Global Research News Hour, occasional public talks, and frequent appearances on radio and at times television.

Stephen Lendman is a Research Associate of the Centre for Research on Globalization. He lives in Chicago and can be reached at lendmanstephen@sbcglobal.net. Also visit his blog site sjlendman.blogspot.com and listen to The Lendman News Hour on RepublicBroadcasting.org Monday - Friday at 10AM US Central time for cutting-edge discussions with distinguished guests on world and national issues. All programs are archived for easy listening.