The Fed’s Monetary Policy of Zero Interest Rates

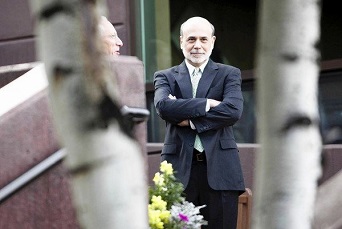

The Federal Reserve, led by Chairman Ben Bernanke, can’t

further stimulate the economy through monetary policies that it

essentially has exhausted already. (David Stubbs/Reuters/CT)

“A More Than Questionable Bernanke Fed Monetary Policy.”

“If the American people ever allow private banks to control the issuance of their currency, first by inflation and then by deflation, the banks and corporations that will grow up around them will deprive the people of all their property until their children will wake up homeless on the continent their fathers conquered.” Thomas Jefferson (1743-1826), 3rd US President

“It is well enough that people … do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” Henry Ford (1863-1947), American automobile industrialist

“When plunder becomes a way of life for a group of men living together in society, they create for themselves, in the course of time, a legal system that authorizes it and a moral code that glorifies it.” Frédéric Bastiat (1801-1850), French economist