What is Britain’s Labour Party for?

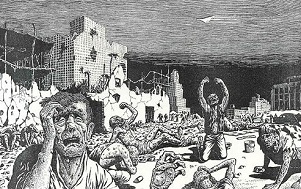

“It doesn’t really matter if it’s Labour or Conservative because the people behind the scenes are always the same...” said a 23 year-old man from Liverpool, who took part in the UK (August 2011) riots. The quote is from a report “Reading the Riots” commissioned by the Guardian and the London School of Economics.

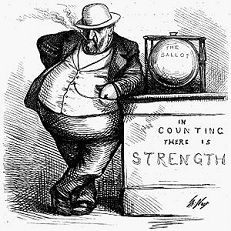

It tells us something that has now become common knowledge, namely that people have lost faith in the democratic process. Politicians and society, all of us, the 99% and the 1% must take heed. People do not like this government, but they do not have much faith in Labour either. This explains why the Labour party is not benefiting from the dire economic situation we find ourselves in. Labour is not trusted. Their so called “light touch regulation” was an abdication of their responsibility to control the explosion of a debt fuelled economy, and the voracious greed of the “moneymen” that brought the country into this sorry state.

Some commentators blame Labour’s difficulties on choosing the wrong leader, Ed Miliband. I think it is the lack of credible policies that lie at the heart of the problem for Labour. It has no vision. It has articulated no alternative policies that are up to the job of tackling the immense problems faced by capitalism today.

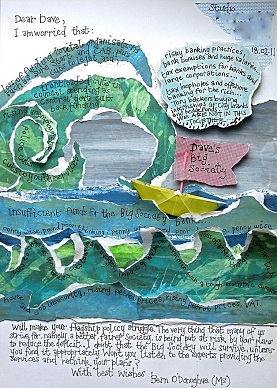

Do they have a policy on bringing a fairer distribution of wealth in a rich country like Britain? A report by the Organisation for Economic Co-operation and Development (OECD), referenced in the Guardian, concludes that “income inequality among working-age people has risen faster in Britain than in any other rich nation since the mid-1970s.” What are their policies on reducing unemployment, particularly among the young, that has now topped one million? What are their policies on reforming the banks and financial institutions? What are their policies to bring a more equitable balance between capital and labour? What are their policies to address the democratic deficit by wresting control from the “moneymen”?