The Lawless Manipulation of Bullion Markets by Public Authorities

Paul Craig Roberts and Dave Kranzler

Note: In this article the times given are Eastern Standard Time. The software that generated the graph uses Mountain Standard Time. Therefore, read the x-axis two hours later than the axis indicates.

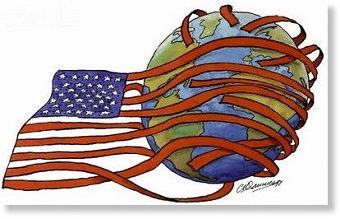

The Federal Reserve and its bullion bank agents are actively using uncovered futures contracts to illegally manipulate the prices of precious metals in order to keep interest rates below the market rate. The purpose of manipulation is to support the U.S. dollar’s reserve status at a time when the dollar should be in decline from the over-supply created by QE and from trade and budget deficits.

Historically, the role of gold and silver has been to function as a means of exchange and a store of wealth during periods of economic and political turmoil. Since the bullion bull market began in late 2000, It rose almost non-stop until March 2008, ahead of the Great Financial Crisis, which started with the collapse of Bear Stearns. When Bear Stearns collapsed, gold was taken down over the course of the next 7 months from $1035 to $680, or 34%; silver from $21 to $8, or 62%. The most violent takedown occurred as Lehman collapsed and Goldman Sachs was about to collapse. This takedown occurred during a period of time when gold should have been going parabolic in price. The price of gold finally took off in late October 2008 from $680 to $1900 while the Government and the Fed were busy printing money to bail out the banks. While the price of gold rose nearly 300% from late 2008 to September 2011, the U.S. dollar lost over 17% of its value, falling from 89 on the dollar index to 73.50.

The current takedown of gold from $1900 to $1200 has occurred during a period of time when financial and political fraud and corruption becomes worse and more blatant by the day. Along with this, the intensity and openness with which the metals are systematically beat down seems to grow by the day.