Morgenson And Rosner’s Reckless Endangerment: Totally Corrupt America

Last March I reviewed Matt Taibbi’s important book Griftopia, an entertaining account of the through-going financial fraud that gave us the financial crisis. Taibbi shows that the US “superpower” can match any third world backwater in the magnitude of greed and fraud that is endemic in business and government. I would not be surprised if Taibbi’s book motivated the more aware participants of Occupy Wall Street.

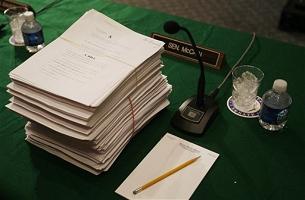

Taibbi’s Griftopia was published last year. This year Henry Holt publishers have provided us with Gretchen Morgenson and Joshua Rosner’s Reckless Endangerment: How Outsized Ambition, Greed, and Corruption Led to Economic Armageddon.

Morgenson and Rosner tell the story again, but with less drama and provocation. Possibly, it might be more acceptable to those gullible Americans who wrap themselves in the flag and refuse to believe that their country could ever knowingly do anything that is wrong.

I am not suggesting that Morgenson and Rosner pull their punches. To the contrary, the authors deliver enough knockouts to be contenders with Taibbi as world champions in exposing the reckless fraud that the US financial sector and its regulators now epitomize.

The financial crisis, which is very much still with us, did not result from accident or miscalculation; neither did it result because of a flaw in Alan Greenspan’s theory, as he told Congress when a feeble effort was made to hold him accountable. It was the intentional result of people motivated by short-term profits who wanted to get theirs and get out.

As Reckless Endangerment shows, fraud characterized every stage of the process from the fraudulent borrower incomes and credit scores that mortgage issuers gave to unqualified buyers, through the securitization of the mortgages and their triple-A investment grade ratings by the rating agencies (Standard & Poor’s especially, but also Moody’s and Fitch) to the investment banks that sold what the banks knew was junk to investors around the world as investment grade securities. Indeed, Goldman Sachs was simultaneously betting against the mortgage derivatives that it was selling to clients.

Investment banks, such as Goldman Sachs, which once considered it a matter of honor to represent the interests of customers, took advantage of the trust that had been built up in the past to commit fraud against customers in order to advance the banks’ short-term profits and the out-sized multi-million dollar managerial bonuses that these fraudulent profits produced.