Truth Is Offensive

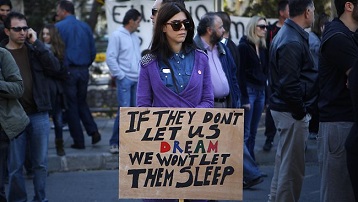

In America truth is offensive. If you tell the truth, you are offensive.

I am offensive. Michael Hudson is offensive. Gerald Celente is offensive. Herman Daly is offensive. Nomi Prins is offensive. Pam Martens is offensive. Chris Hedges is offensive. Chris Floyd is offensive. John Pilger is offensive. Noam Chomsky is offensive. Harvey Silverglate is offensive. Naomi Wolf is offensive. Stephen Lendman is offensive. David Ray Griffin is offensive. Ellen Brown is offensive.

Fortunately, many others are offensive. But how long before being offensive becomes being “an enemy of the state”?

Throughout history truth tellers have suffered and court historians have prospered. It is the same today. Gerald Celente illustrates this brilliantly in the next issue of the Trends Journal.

Over the past 35 years I have learned this lesson as a columnist. If you tell readers what is really going on, they want to know why you can’t be positive. Why are you telling us that there are bad happenings that can’t be remedied? Don’t you know that God gave Americans the power to fix all wrongs? What are you? Some kind of idiot, an anti-American, a pinko-liberal-commie? If you hate America so much, why don’t you move to Cuba, Iran or China (or to wherever the current bogyman is located)?

The ancient Greeks understood this well. In Greek mythology, Cassandra was the prophetess who no one believed despite her 100 percent record of being right. Telling the truth to Americans or to Europeans is just as expensive as telling the truth to the Greeks in ancient mythology.