Real liars go to Tehran

Uncle Marx never thought about this one: history repeating itself as double tragedy after already being a farce in the first place. Let's examine the case in hand. First of all, take a close look at this Wall Street Journal op-ed from September 2002, in the hysterical run-up towards the invasion of Iraq.

Title: The Case for Toppling Saddam. Author: Benjamin "Bibi" Netanyahu - then out of the Israeli government. It's all here:

[a] "dictator who is rapidly expanding his arsenal of biological and chemical weapons" and "who is feverishly trying to acquire nuclear weapons"; the Saddam equals Hitler parallel; the portrayal of (de facto nuclear power) Israel as helpless victims of Palestinian "terror"; the claim that Saddam could produce nuclear fuel "in centrifuges the size of washing machines that can be hidden throughout the country - and Iraq is a very big country"; the cheerleading of a unilateral pre-emptive strike; and the inevitable conclusion that "nothing less than dismantling his regime will do''.

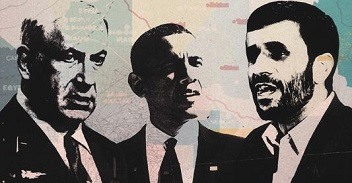

Fast-forward over 10 years to this week in Israel. The scene: press conference of Israeli Prime Minister Bibi Netanyahu and visiting US President Barack Obama. Anyone watching it live on al-Jazeera, from the Middle East to East Asia, must have thought they were watching a geopolitical Back to the Future - and frankly, Michael J Fox at least oozed charm. No charm here; this was more like an eerie, suit-and-tie Return of the Living Dead. Bibi and Obama were at pains to stress the US-Israel bond was "eternal".