Europe in crisis as Cyprus faces national bankruptcy

Jordan Shilton & Chris Marsden

The vote by Cyprus’s parliament Tuesday evening to reject the terms of the European Union (EU) bailout agreed last Saturday has deepened a crisis which threatens to spread across Europe, posing the risk of national bankruptcy.

Thirty-six parliamentarians voted against the deal, while 19 abstained and none voted in favour. The initial bailout plan would have charged investors with deposits in Cypriot bank accounts a tax of 9.9 percent for those with account balances of more than €100,000, and 6.75 per cent for those with balances between €25,000 and 100,000. This would have raised €5.8 billion to support the proposed €10-billion-euro EU bailout for Cyprus’ banks.

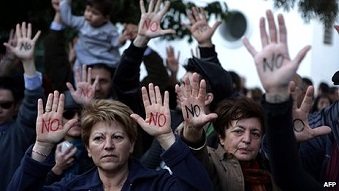

With thousands gathered outside parliament to protest, a last-minute adjustment to exempt those with less than €20,000 from the levy had no impact.

President Nikos Anastasiades called an emergency meeting of all political parties to work on a “Plan B.” But a proposed alternative it drew up yesterday was rejected by the troika—the European Commission, the European Central Bank and the International Monetary Fund.

The total collapse of Cyprus’s financial system is being avoided only by the continued closure of the banks, which will now be kept shut until next Tuesday. The stock market also announced on Tuesday it would close for two days, amid fears that investors would withdraw large quantities of capital.