QE4: Forgive the Students

Among the demands of the Wall Street protesters is student debt forgiveness—a debt “jubilee.” Occupy Philly has a “Student Loan Jubilee Working Group,” and other groups are studying the issue. Commentators say debt forgiveness is impossible. Who would foot the bill? But there is one deep pocket that could pull it off—the Federal Reserve. In its first quantitative easing program (QE1), the Fed removed $1.3 trillion in toxic assets from the books of Wall Street banks. For QE4, it could remove $1 trillion in toxic debt from the backs of millions of students.

The economy would only be the better for it, as was shown by the G.I. Bill, which provided virtually-free higher education for returning veterans, along with low-interest loans for housing and business. The G.I. Bill had a sevenfold return. It was one of the best investments Congress ever made.

There are arguments against a complete student debt write-off, including that it would reward private universities that are already charging too much, and it would unfairly exclude other forms of debt from relief. But the point here is that it could be done, and it (or some similar form of consumer “jubilee”) would represent a significant stimulus to the economy.

Toxic Student Debt: The Next “Black Swan”?

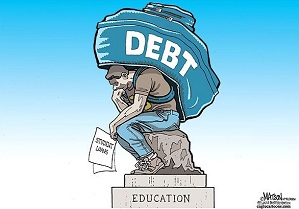

The Occupy Wall Street movement is heavily populated with students. Many without jobs, they are groaning under the impossible load of student debts that have been excluded from the usual consumer protections. A whole generation of young people has been seduced into debt peonage by the promise of better jobs if they invest in higher education, only to find that the jobs are not there when they graduate. If they default on their loans, lenders can now jack up interest rates and fees, garnish wages, and destroy credit ratings; and the debts can no longer be discharged in bankruptcy.

Total U.S. student debt has risen to $1 trillion—more than U.S. credit card debt. Defaults are rising as well. According to Department of Education data, 8.8 percent of recipients of federal student loans defaulted in FY 2010, up from 7 percent the previous year. With an anemic recovery from a severe recession and a difficult job market, the situation is expected to get worse. The threat of massive student loan defaults requiring another taxpayer bailout has been called a systemic risk as serious as the bank failures that brought the U.S. economy to the brink of collapse in 2008. To prevent another disaster like the one caused by the toxic debts on the books of Wall Street banks, we need to defuse the student debt bomb before it blows. But how?

The Federal Reserve could do it in the same way it defused the credit crisis of 2008: by aiming its fire hose of very-low-interest credit in the direction of the struggling student population. Since September 2008, the Fed has made trillions of dollars available to financial institutions at a fraction of 1% interest; and in audits since then, we’ve seen that the Fed is capable of coming up with any amount of money required or desired. To the Fed it is all just accounting entries, available with the stroke of a computer key.

The Fed is not allowed to lend to individuals directly, but it can buy Treasury securities; and with the Student Aid and Fiscal Responsibility Act (SAFRA) of March 2010, the Treasury is now formally in the business of student lending. The Fed can also buy asset-backed securities, including securitized student debt; and there is talk of another round of quantitative easing aimed at just that sort of asset.

After QE3: The Market Wants More

When the Federal Reserve’s expected “QE3” turned into the tepid and ineffectual “Operation Twist,” the stock market reacted by plummeting. To appease investors, Chairman Ben Bernanke then assured them that the Fed was “ready to do more.” How much more and in what way wasn’t specified; but Alan Blinder, former Vice Chairman of the Federal Reserve Board of Governors, suggested some possibilities. He wrote in the Wall Street Journal on September 28th:

To maintain the size of its balance sheet, the Fed has been reinvesting the proceeds in Treasurys. But starting "now" (the Fed's word), and continuing indefinitely, those proceeds will be reinvested in agency bonds and MBS instead. . . . A future round of quantitative easing (QE4?) that concentrates on private-sector securities like MBS, rather than on Treasurys, is now imaginable. . . . Indeed, if we indulge ourselves in a bit of blue-sky thinking, we can even imagine the Fed doing QEs in corporate bonds, syndicated loans, consumer receivables and so forth.

Syndicated consumer loans include asset-backed securities (ABS) of the sort purchased by the Fed through its Term Asset-backed Securities Loan Facility (TALF) created in November 2008. According to the Fed’s website, “Eligible collateral initially included U.S. dollar-denominated ABS that . . . are backed by student loans, auto loans, credit card loans, and loans guaranteed by the Small Business Administration (SBA) . . . .”

Buying securities backed by bundles of student loans thus falls within the Fed’s purview. Quantitative easing is a tool reserved for economic crises, and toxic student debt appears to be the next “black swan” on the horizon.

Buying up a trillion dollars in student loans could be a nice stimulus package for the economy. The money supply is estimated to have shrunk by about $3 trillion since the 2008 collapse of the “shadow” banking system (an array of non-bank financial institutions including investment banks, hedge funds, money market funds, SIVs, conduits, and monoline insurers). In July 2010, the New York Fed posted a staff report on its website titled “Shadow Banking,” showing that the shadow banking system had contracted by $4 trillion since its peak in March 2008, when it was valued at about $20 trillion—actually larger than the traditional banking system, which was then only about $12 trillion. By July 2010, the shadow system was down to about $16 trillion and the traditional system was up to about $13 trillion, leaving a $3 trillion gap to be filled. Adding back a trillion dollars in student aid could go a long way toward curing this shortfall.

Debt Relief as Economic Stimulus

What could such a stimulus do for the economy? Consider the G.I. Bill, which provided free technical training and educational support, along with government-subsidized loans and unemployment benefits, for nearly 16 million returning servicemen. Economists have determined that for every 1944 dollar invested, the country received approximately $7 in return, through increased economic productivity, consumer spending, and tax revenues. The G.I. Bill not only made higher education accessible to all, but it created a nation of homeowners, new technology, new products, and new companies, with the Veterans Administration guaranteeing an estimated 53,000 business loans.

Eliminating, reducing or deferring student loan debt would free up the budgets of millions of students, allowing them to spend more on goods and services, increasing demand and creating jobs. More jobs would mean more taxes for the government, and a more educated and skilled work force would mean higher paying jobs in higher tax brackets.

What the economy sorely needs today is purchasing power. Without customers to buy their products, businesses cannot expand and cannot hire. And to get the needed purchasing power, consumers need more money in their pockets. Getting it there by quantitative easing has been branded dangerously inflationary, but with a $3 trillion hole in the money supply, we need an injection of new money today. As long as the money is spent on goods and services rather than on financial money-making-money schemes, the result will not be inflationary. Retailers will just put in more orders for goods, causing producers to produce more and to hire more workers to do it. Supply will rise along with demand, keeping prices stable. Overall prices will not increase until the country hits full employment, which is far from where we are today.

Another Alternative: Interest-free Student Loans

Many countries offer free tuition for higher education, including Argentina, Brazil, Denmark, Finland, Greece, Norway, Scotland, and Sweden. Another program that has proven to be very fair and workable is a program of interest-free student loans. The government of New Zealand now offers 0% loans to New Zealand students, with repayment to be made from their income after they graduate. For the past twenty years, the Australian government has also successfully funded students by giving out what are in effect interest-free loans.

The loans in the Australian Higher Education Loan Programme (or HELP) do not bear interest, but the government gets back more than it lends, because the principal is indexed to the Consumer Price Index (CPI), which goes up every year. The indexation rate was 2.8% in 2006 and 3.4% in 2007. To avoid this increase, borrowers can make voluntary repayments, for which they also get a 10% reduction in the principal. Thus if a person voluntarily repays $1000, the debt is reduced by $1100. The loans are “contingent loans,” repaid only if and when the borrower’s income reaches a certain level. If the borrower dies, any compulsory repayment must be paid from his estate, but the remainder of the debt is canceled at death.

Following the Australian model, the Federal Reserve could buy up $1 trillion in U.S. student debt, waive the interest, and collect on the principal only when the borrowers’ incomes reach a certain level. In the meantime, the loan money would circulate in the economy, stimulating economic activity.

Even assuming a 10% default rate, the Fed would get back $900 billion on its $1 trillion advance. The $100 billion difference is only one-seventh the bailout money authorized by Congress to rescue Wall Street banks, and it would stimulate the economy more than the bailout money, which just shored up the balance sheets of insolvent Wall Street banks—banks that then declined to return the favor by lending to Main Street. If the Fed’s investment generated anything close to the returns from the G.I. Bill, its $100 billion outlay could produce a several-hundred-billion dollar return.

To prevent abuse of the system, colleges should be required to stay within certain well-defined parameters for providing affordable, high quality education; and students should meet well-defined standards as well.

Properly monitored, a federal investment in higher education can be a win-win-win, good for the economy, good for the government, and good for the people. A generous student loan program will create jobs, increase tax revenues, and give young people a fair shot at the American dream, a dream that has become a mirage for 99% of the population.

___________________________________________________________________________________

Ellen Brown developed her research skills as an attorney practicing civil litigation in Los Angeles. In Web of Debt: The Shocking Truth About Our Money System and How We Can Break Free (2010), her latest of eleven books. She turns those skills to an analysis of the Federal Reserve and “the money trust.” She shows how this private cartel has usurped the power to create money from the people themselves, and how we the people can get it back. She also is president of the Public Banking Institute. Her websites are www.webofdebt.com, www.ellenbrown.com, and www.public-banking.com.

___________________________________________________________________________________

Cartoon: RJ Matson / Matson Cartoons | St. Louis Post-Dispatch

Published here: http://www.webofdebt.com/articles/

URL: http://www.a-w-i-p.com/index.php/2011/10/21/qe4-forgive-the-students